post

December 8, 2015

What the U.S. Can Learn from Mobile Payments in Africa

Mobile payments have exploded in popularity just within the past year—40% of U.S. consumers have used mobile payments in 2015, compared to just 8% in 2014. In fact, mobile transactions are expected to surpass half a trillion dollars ($560 billion) in 2016, and Gartner predicts that mobile commerce will make of 50% of all U.S. digital commerce by 2017.

So why the startling change?

Part of this mobile payment boom can be attributed to the popularity of Near Field Communications (NFC), which uses a specialized receiver to read a chip in customer’s phone. The most well-known examples of NFC are Starbucks’ mobile payment app, which manages more than 8 million transactions a week, and ApplePay, whose October 2014 debut even reignited interest in competing mobile pay platforms like Google Wallet.

However, mobile payments in the U.S. haven’t seen the success these numbers might lead you to believe. Over 80% of iPhone users still haven’t tried Apple Pay, and although Starbucks manages millions of transactions a week, they’re just a fraction of the mobile payment market. Mobile money has gained predominance out of circumstance rather than convenience’s sake outside of the U.S., and they’ve seen great success.

It turns out the most successful mobile payment company has eschewed mobile apps altogether in favor of something far simpler: the text message.

Mobile payments in Africa and the rise of M-Pesa

Companies like Magic have already proved that texting is a great way to pay for things, but they weren’t the first ones to pioneer this concept. Vodafone had already thought of it first.

Launched in 2007, M-Pesa (M for mobile, pesa the Swahili word for money) was created by Vodafone for Safaricom and Vodacom as way to transfer money over mobile phones, as well to serve as a microfinancing service. The service lets users send, receive and deposit money into their accounts, all of which is managed through text messages secured by PIN numbers.

M-Pesa has grown to become Africa’s mobile payment giant, boasting more than 15 million users and handling US $21 million in transactions every day. M-Pesa users can use the service to:

- Make bulk payments

- Buy Safaricom airtime

- Deposit cash into their account

- Manage their account

- Pay bills

- Send (transfer) money

- Withdraw money

- Pay for goods like solar lighting, water, and groceries

But why the reliance on mobile and text messaging for payments? As Vanessa Clark points out in her Techcrunch article, there are three factors that have driven the use of mobile money in Africa:

Firstly…there were fewer than two million mobile phones users in Africa in 1998. This number grew to more than 400 million by 2009…Secondly, there are a large number of unbanked, and underbanked, people in Africa. A 2009 World Bank report puts this figure at as high as 70% of Africans…Finally, much of the continent’s population lives in rural areas, with very little access to banking infrastructure.

The proliferation of mobile payments over text message in Africa can’t be understated. Over 80% of Africans use their cell phones to text, and 30% use their phone to make and receive payments. This last number more than doubles in Kenya (where M-Pesa originated), with 61% of Kenyans using their phone for mobile payments. In contrast, only 2% of Africans have a working landline phone, further accentuating the prevalence and importance of mobile there.

All of which raises the question: If texting to pay is so successful in Africa, who’s to say it won’t see the same success here?

Why Companies Need to Offer Text to Pay

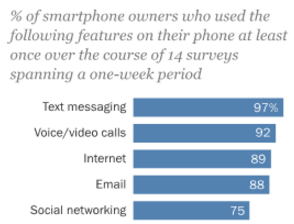

In the U.S., mobile is also a part of everyday life, but mobile payments haven’t seen nearly the same amount of success as they have in Kenya. And while the most common ways to make mobile payments include mobile wallets (which rely on NFC for transactions), mobile browsers and payment applications, all of these payments are predicated on the fact that customers have a reliable internet connection, or a specific chip in their phone. It’s a lot to expect of a customer, especially when internet use (which is needed for mobile payments in the U.S.) isn’t even the most popular feature on a smartphone.

That honor goes to text messaging.

Now imagine if businesses applied the same excitement that they did for mobile apps to text messaging. They could make mobile payments more accessible to a larger percentage of their client base. Not everyone has a smartphone or access to an internet connection, so businesses that don’t offer texting might be shutting potential customers out. For customers that do have a smartphone, they won’t always want to download an app for each specific store or chain they visit, so businesses could make sure they were still reaching all of their customers with text messaging.

Texting is also a secure way to pay—all businesses would have to do is direct customers to a secured webpage where they can enter their payment details. Customers also don’t have to be in the same location as their purchase to make a mobile payment, and they can still get the details of their purchase with pictures and descriptions of the items they’re interested in.

Conclusion

There’s nothing wrong with the way mobile payments are currently being processed in the U.S. NFC, online payments and applications all have a role to play in how we pay. But imagine what we could learn from mobile payments in Africa, if we opened up accessibility to more customers with texting.

The payoff would be huge.

To learn more about the benefits of adding texting to your mobile strategy, download our whitepaper here.

Image from Afritorial. Edited.

Stay up to date

Latest Articles

OneReach.ai Named a Leader in the IDC MarketScape for Conversational AI Software 2023

December 18, 2023