The finance function is undergoing a profound digital transformation. As businesses navigate growing complexity and economic uncertainty, finance teams are expected to deliver faster, more accurate insights while maintaining agility and strategic foresight. In this high-stakes environment, AI agents in finance are emerging as a game-changing solution, helping organizations embrace the future of smart finance.

Unlike traditional AI tools, AI agents are autonomous, goal-oriented systems capable of handling complex tasks such as data analysis, forecasting, and scenario modeling, freeing finance professionals to focus on higher-level decision-making. A McKinsey survey highlights: over 8 in 10 CFOs believe that AI will unlock insights that allow employees to focus more on value-adding tasks and improve overall productivity. [1]

As we’ll explore in this post, AI agents in finance are redefining planning, forecasting, and analysis — ushering in a new era of intelligent, agile, and smart finance operations.

AI Agents and Their Role in Finance

AI agents in finance represent a new class of intelligent systems designed to operate autonomously and achieve specific goals. Financial AI agents can independently gather data, analyze information, and make context-aware decisions. They work as collaborators, capable of handling dynamic tasks such as forecasting, budget variance analysis, and risk scenario modeling.

These agents form the foundation of the AI finance advisor — an always-on, data-driven assistant that supports finance teams in making faster, smarter decisions. Whether identifying anomalies in spending or proactively recommending strategic adjustments, AI finance advisors bring agility and intelligence to day-to-day financial operations.

As the Head of AI for Financial Services & Telecom, EMEA at a US BigTech firm said:

“As businesses ramp up AI spends and hunt for return on investment (ROI), Agentic AI is the new frontier that orchestrates a whole zoo of AI models of all sizes and modalities to automate processes and materialize productivity gains.”

With this emerging wave of Agentic automation, AI agents are unlocking a new model of intelligent, scalable operations — redefining what’s possible across the financial landscape.

Financial Planning with AI Agents

Traditional financial planning often relies on static, annual forecasts that quickly become outdated in today’s fast-paced business environment. AI agents are changing that by enabling continuous planning that evolves in real time. AI for finance transforms the planning process from a rigid, one-time activity into a dynamic, data-driven function that adapts to changing conditions. Instead of relying solely on historical data and manual updates, financial AI agents process live data streams to generate accurate, up-to-date insights.

Figure 1: AI Agents in Financial Planning

These intelligent capabilities mean finance teams no longer need to wait for quarterly reviews or end-of-year cycles to recalibrate plans. AI agents deliver faster, more responsive insights — improving agility, minimizing risk, and unlocking better decision-making. Key benefits include:

- Shorter planning and forecasting cycles,

- Improved strategic alignment with organizational goals,

- Reduced reliance on manual data entry and spreadsheet-driven workflows.

With AI agents in finance, organizations are moving to proactive planning, empowering finance leaders to drive effective strategy.

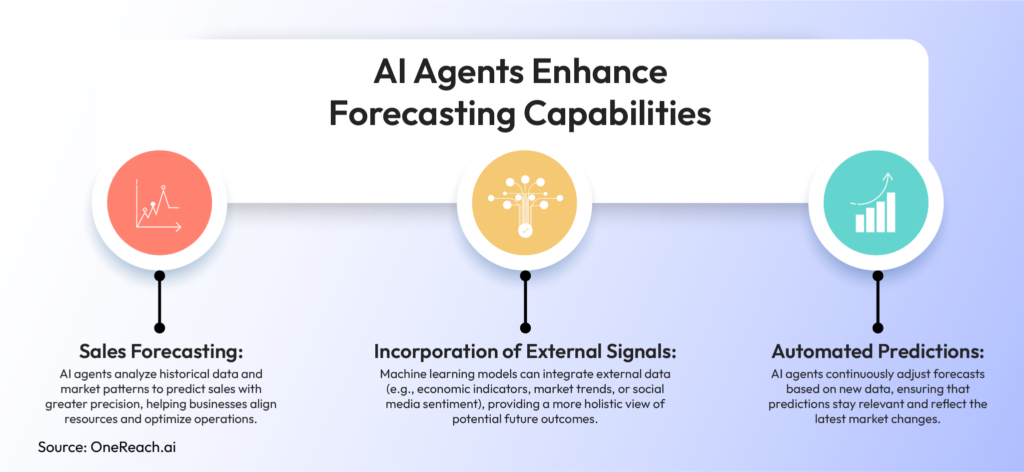

Precision Forecasting Powered by Agentic AI

In the world of finance, precision forecasting is key to making informed, data-driven decisions. AI agents in finance are transforming the forecasting process by leveraging machine learning algorithms, external signals, and real-time data to predict future trends more accurately.

Figure 2: AI Agents Enhance Forecasting Capabilities

Benefits include:

- By accurately forecasting trends, businesses can proactively manage risks and adjust strategies before issues arise.

- Real-time, accurate predictions empower finance teams to make faster, smarter decisions, adapting swiftly to dynamic market conditions.

Agentic AI unlocks the power of predictive analytics, offering enhanced accuracy and speed in forecasting, making it a useful tool for future-proofing financial strategies.

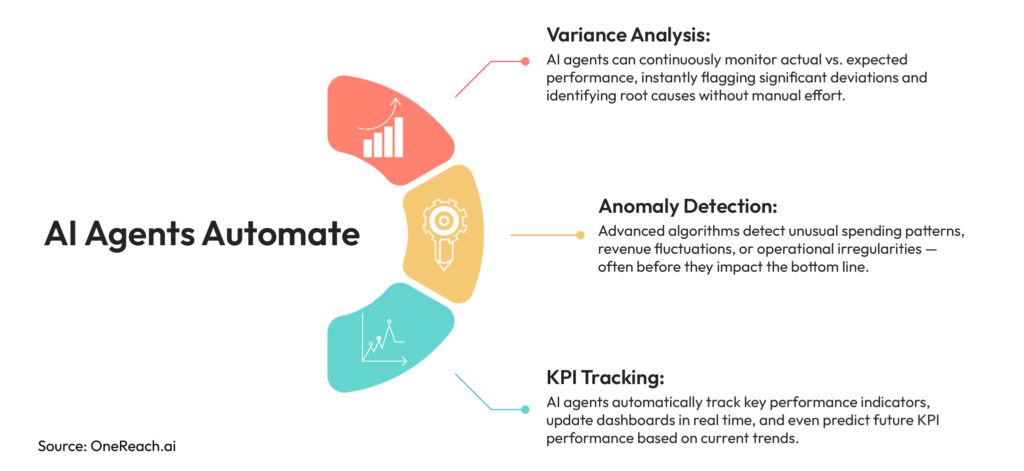

Real-Time Financial Analysis and Insights

AI agents in financial services are changing the way organizations analyze and respond to financial data. By automating tasks like variance analysis, anomaly detection, and KPI (key performance indicators) tracking, AI enables real-time insights that drive smarter, faster decisions.

An example of Agentic AI in action is an AI finance advisor that finance managers can interact with directly, asking questions like, “Why did Q3 expenses spike in marketing?” and receiving immediate, context-rich answers. These autonomous agents don’t just retrieve data, they analyze it, explain trends, and offer actionable insights in real time.

Benefits include:

- Real-time analysis replaces time-consuming manual reporting.

- AI agents provide context and trends, not just numbers.

- Teams can act immediately on issues or opportunities as they emerge.

Get a free technical demo of GSX and see how to securely govern AI agents across your organization

Free DemoHuman + AI Agents Collaboration

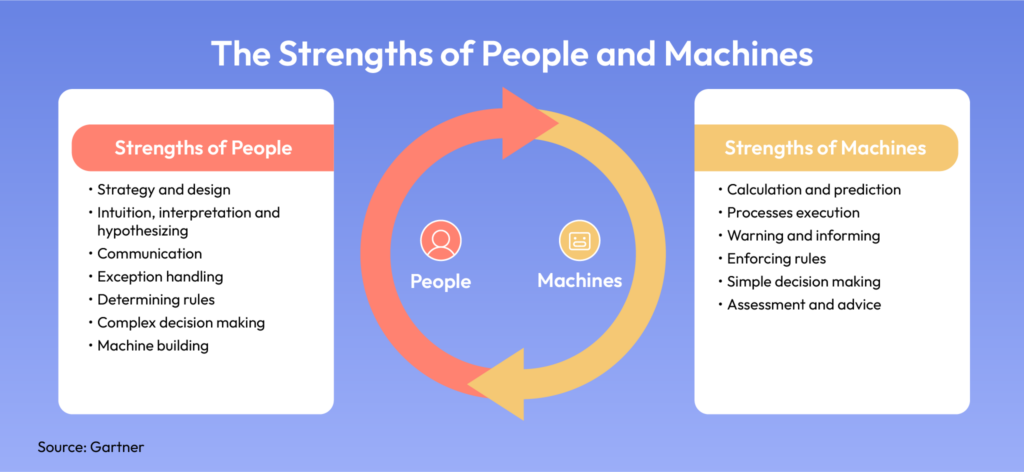

Using Agentic AI means to empower finance teams. Financial AI agents provide real-time insights that enhance human decision-making. This partnership fosters a culture of augmented intelligence, where human expertise is amplified by machine precision.

AI finance advisors deliver instant trend analysis, risk assessments, and performance snapshots, allowing finance teams to focus on strategy and interpretation rather than data crunching. Human judgment remains central, especially in nuanced areas, such as security and ethical considerations, long-term planning, and leadership decisions.

By integrating AI agents in finance, organizations gain the speed and scale of automation while preserving the critical thinking and creativity of their teams. Together, humans and financial AI agents form a smart, strategic duo.

Figure 4: The Strengths of People and Machines

The Future of Agentic AI in Finance

The future of AI in finance is increasingly Agentic, driven by the rise of intelligent systems capable of autonomously managing complex financial processes. As AI agents in finance mature, there will be deeper integration with enterprise resource planning (ERP) systems, enabling seamless data flow and automated actions — from forecasting and budgeting to compliance and reporting.

One of the most promising developments is autonomous finance AI agents: systems that can analyze data, make and execute routine financial decisions, such as reallocating budgets, flagging risks, or initiating alerts. These agents will allow users to interact naturally with financial systems — asking questions like, “What’s driving our margin decline this quarter?” and receiving instant, contextual answers.

The future of finance is agile, autonomous, and insight-driven, powered by AI agents ready to unlock new levels of performance and resilience.

AI Agents in Transformation of Finance

Deploying Agentic AI in financial processes brings speed, precision, and smarter decision-making to the forefront. From real-time analysis to predictive planning, AI agents streamline complex processes and free teams to focus on strategy. With 90% of finance functions expected to deploy at least one AI-enabled technology solution by 2026 [2], now is the time for finance leaders to act.

OneReach.ai Agentic AI Automation and Orchestration Platform empowers organizations to create and orchestrate intelligent AI agents that integrate seamlessly with financial systems and workflows, no coding required. With the Generative Studio X platform, finance teams can rapidly deploy secure, scalable Agentic AI solutions tailored to their unique planning, forecasting, and analysis needs.